Borsa İstanbul, a key institution in making İstanbul an international financial center as part of Türkiye’s 2023 vision, continues to invest in technology and enhance its system/application infrastructure to deliver the highest global standards. In this context, as a result of the strategic cooperation with NASDAQ, all markets within Borsa İstanbul migrated to BISTECH (based on GeniumINET) to serve on a common trading platform and execute trade and post trade operations single handedly.

With the launch of BISTECH System, maximum capacity that exchange can process has reached to 100.000 orders per second and the round-trip latency has decreased as low as to microseconds. Thanks to world known order entry and data dissemination protocols coming along with BISTECH, local and international investors can access to Borsa İstanbul much more easily without incurring additional development costs.

FAZ 1 > Equity Market (30/11/2015)

FAZ 2 > Derivatives Market (6/03/2017)

FAZ 2+ > Debts Securities Market and Precious Metals and Diamond Market (02/07/2018)

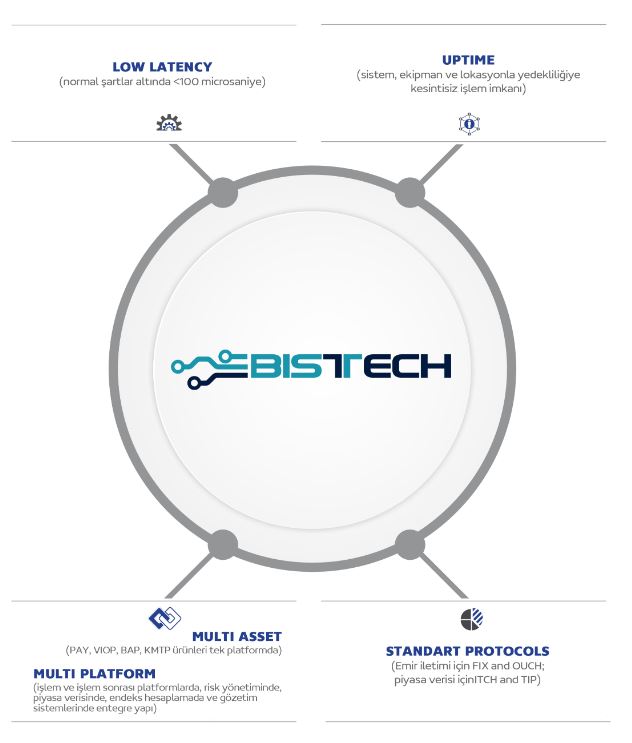

- Low Latency (Under normal conditions <100 microsecond)

- Uptime (Continuous trading with system, equipment and location redundancy)

- Multi asset (Equities, derivatives, debt securities and precious metals’ products are in the same platform)

- Multi platform (integrated trade, post-trade, risk management, market data, index calculation, surveillance systems)

- Standart Protocols (FIX and OUCH for order entry; ITCH and TIP for market data)