Markets in the below table are created with respect to contracts types executed in the market and execution principles.

Matching or orders and private trade notifications are realized under the relevant market. Besides, market segments are defined under the relevant market to publish collective trade statistics.

| Markets | |

|---|---|

| 1 | VIOP Equity Derivatives Market |

| 2 | VIOP Index Derivatives Market |

| 3 | VIOP Foreign Indices Derivatives Market |

| 4 | VIOP Currency Derivatives Market |

| 5 | VIOP ETF Derivatives Market |

| 6 | VIOP Precious Metals Derivatives Market |

| 7 | VIOP Metal Derivatives Market |

| 8 | VIOP Interest Rate Derivatives Market |

| 9 | VIOP Commodity Derivatives Market |

| 10 | VIOP Base Load Electricity Derivatives Market |

| 11 | VIOP Government Bond Derivatives Market |

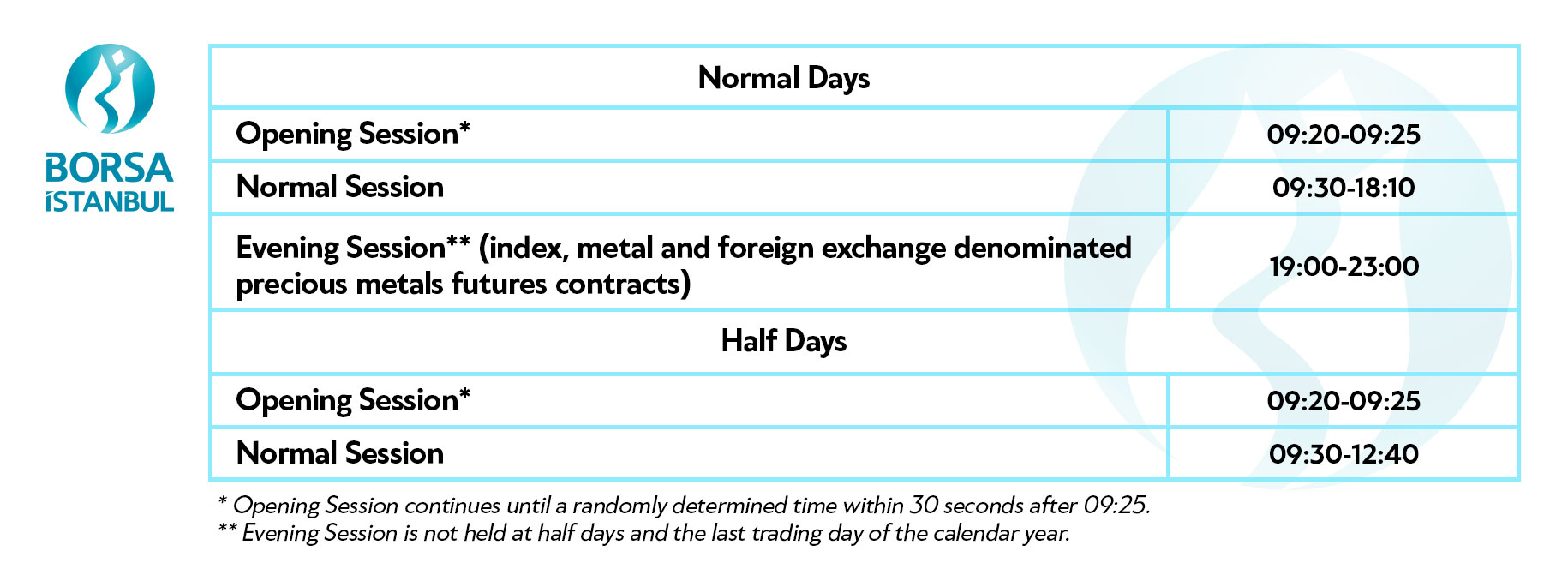

Detailed information on the workflow of the trading sessions can be found in the Appendix-3 Explanations on Trading Day Sections And VIOP's Trading and Daily Workflow Hours of VIOP Procedure.

In order to trade at VIOP, an investor need to open an account at one of brokerage houses or banks registered as VIOP member.

| Member Name | Phone Number/ E-mail | Futures Contracts | Option Contracts | Foreign Languages Served |

|---|---|---|---|---|

| ACAR YATIRIM MENKUL DEĞERLER A.Ş. www.acar.com.tr | 0 212 216 26 61 viop@acar.com.tr | + | - | English |

| AK YATIRIM MENKUL DEĞERLER A.Ş. www.akyatirim.com.tr | 0 212 334 95 30 Turev_Islemler_Satis@ akyatirim.com.tr | + | + | English + German |

| ALAN MENKUL DEĞERLER A.Ş. www.alanmenkul.com | 0 212 370 22 22 info@alanyatirim.com.tr | + | - | English |

| ALB MENKUL DEĞERLER A.Ş. www.albforex.com.tr | 0 212 370 03 33 viop@albforex.com.tr | + | - | English |

| ALNUS YATIRIM MENKUL DEĞERLER A.Ş. www.alnusyatirim.com | 0 212 213 08 00 bilgiislem@alnusyatirim.com operasyon@alnusyatirim.com | + | - | English |

| ALTERNATİF YATIRIM A.Ş. www.ayatirim.com.tr | 0 212 315 66 61 alternatifyatirim.com.tr | + | - | English |

| ANADOLU YATIRIM MENKUL DEĞERLER A.Ş. www.anadoluyatirim.com.tr | 0 216 649 77 00 adyyurticipiyasalar@ anadoluyatirim.com.tr | + | + | - |

| ATA YATIRIM MENKUL KIYMETLER A.Ş. www.atayatirim.com.tr | 0 212 310 62 00 ATAVIOP@atayatirim.com.tr | + | + | English |

| BANK OF AMERİCA YATIRIM BANK A.Ş www.ml.com.tr | 0212 319 95 00 dg.ml_bank_muhaberat@ bofa.com | + | - | English |

| BGC PARTNERS MENKUL DEĞERLER A.Ş. tr.bgcpartners.com | 0 212 339 42 10 Bgc.viop@bgcpartners.com | + | - | English |

| BİZİM MENKUL DEĞERLER A.Ş. www.bmd.com.tr | 0 216 547 13 00 viop@bizimmenkul.com.tr | + | - | English |

| BURGAN YATIRIM MENKUL DEĞERLER A.Ş. www.burganyatirim.com.tr | 0 212 317 28 28 viop@burganyatirim.com.tr | + | + | English |

| CREDIT SUISSE İSTANBUL MENKUL DEĞERLER A.Ş. www.credit-suisse.com | 0 212 349 0414 list.csimd@credit-suisse.com | + | - | English |

| DENİZ YATIRIM MENKUL KIYMETLER A.Ş. www.denizyatirim.com | 0 212 348 90 90 DenizYatirimTurevIslemleriYurticiGrubu@ denizbank.com | + | + | English |

| GARANTİ YATIRIM MENKUL KIYMETLER A.Ş. www.garantiyatirim.com.tr | 0 212 384 10 10 gyatirimviop@garantibbva.com.tr | + | + | English |

| GEDİK YATIRIM MENKUL DEĞERLER A.Ş. www.gedik.com | 0 216 453 01 23 vadeli@gedik.com | + | + | English |

| GLOBAL MENKUL DEĞERLER A.Ş. www.global.com.tr | 0212 244 55 66 viop@global.com.tr | + | + | English |

| HALK YATIRIM A.Ş. www.halkyatirim.com.tr | 0212 314 8102 turevaraclar@halkyatirim.com.tr | + | - | English |

| HSBC YATIRIM MENKUL DEĞERLER A.Ş. www.hsbcyatirim.com.tr | 0212 376 46 53 turevpiyasalarislemleri@ hsbc.com.tr | + | - | English |

| IKON MENKUL DEĞERLER A.Ş. www.ikonmenkul.com.tr | 0212 454 84 00 yurtici@ikonmenkul.com.tr | + | + | - |

| INFO YATIRIM A.Ş. www.infoyatirim.com | 0212 700 3500 viopislem@infoyatirim.com.tr | + | + | English |

| ING MENKUL DEĞERLER A.Ş. www.ingmenkul.com.tr | 0212 367 70 00 ingyatirimso@ingyatirim.com.tr | + | + | English |

| İŞ YATIRIM MENKUL DEĞERLER A.Ş. www.isyatirim.com.tr | 0212 350 22 64 TakasOperasyonlari-TurevIslemler @isyatirim.com.tr hazine@isyatirim.com.tr upfx@isyatirim.com.tr | + | + | English |

| MARBAŞ MENKUL DEĞERLER A.Ş. www.marbasmenkul.com.tr | 0 212 286 30 00 marbasmenkul.com.tr | + | + | - |

| MEKSA YATIRIM MENKUL DEĞERLER A.Ş. www.meksa.com.tr | 0 216 681 34 25 viop@meksa.com.tr | + | + | English |

| METRO YATIRIM MENKUL DEĞERLER A.Ş. www.metroyatirim.com.tr | 0 212 344 09 00 viop@metroyatirim.com.tr | + | + | - |

| NOOR CAPITAL MARKET MENKUL DEĞERLER A.Ş. www.noorcm.com.tr | 0 212 280 66 66 viop@noorcm.com.tr | + | + | English |

| OSMANLI YATIRIM MENKUL DEĞERLER A.Ş. | 0212 366 8848 trading@osmanlimenkul.com.tr | + | + | - |

| OYAK YATIRIM MENKUL DEĞERLER A.Ş. www.oyakyatirim.com.tr | 0212 319 12 95 vadeli@oyakyatirim.com.tr | + | + | English |

| PİRAMİT MENKUL DEĞERLER A.Ş. www.piramitmenkul.com.tr | 0212 395 32 03 viop@piramitmenkul.com.tr | + | + | English |

| QNB YATIRIM MENKUL DEĞERLER A.Ş. www.finansinvest.com | 0212 336 71 65 HAZINE@qnbfi.com | + | + | English |

| SANKO MENKUL DEĞERLER A.Ş. www.sankomenkul.com | 0 212 410 05 40 0 212 410 05 12 viop@sankomenkul.com | + | + | English |

| ŞEKER YATIRIM MENKUL DEĞERLER A.Ş. www.sekeryatirim.com | 0 212 334 33 33 (211) 0 212 334 33 33 (154) viop@sekeryatirim.com.tr | + | + | English |

| TACİRLER YATIRIM MENKUL DEĞERLER A.Ş. www.tacirler.com.tr | 0212 355 46 09 0212 355 26 79 viop@tacirler.com.tr | + | + | English |

| TEB YATIRIM MENKUL DEĞERLER A.Ş. www.tebyatirim.com.tr | 0 216 636 44 32 0 216 636 45 07 turevveforeksislemleri@ teb.com.tr | + | + | English |

| TERA MENKUL DEĞERLER A.Ş. www.teramenkul.com | 0212 365 10 00 vioptera@terayatirim.com | + | + | English |

| TURKISH YATIRIM MENKUL DEĞERLER A.Ş. www.turkishyatirim.com | 0212 315 10 33 0212 315 10 50 viop@turkishyatirim.com | + | + | - |

| ÜNLÜ MENKUL DEĞERLER A.Ş. www.unluco.com | 0 212 367 37 20 unluoperations@unluco.com | + | + | English |

| VAKIF YATIRIM MENKUL DEĞERLER A.Ş. www.vakifyatirim.com.tr | 0212 352 35 77 vkyturev@vakifyatirim.com.tr | + | + | - |

| VENBEY YATIRIM MENKUL DEĞERLER A.Ş. www.venbeyyatirim.com | 0 212 272 72 00 viop@venbeyyatirim.com | + | - | English |

| YAPI KREDİ YATIRIM MENKUL DEĞERLER A.Ş. www.yapikrediyatirim.com | 0 212 319 80 00 YKY_Turev@ykyatirim.com.tr | + | + | English |

| YATIRIM FİNANSMAN MENKUL DEĞERLER A.Ş. www.yf.com.tr | 0 212 317 68 32 0 212 317 68 32 |

|

| English |

| ZİRAAT YATIRIM MENKUL DEĞERLER A.Ş. www.ziraatyatirim.com.tr | 0 212 339 80 72 turevaraclar@ziraatyatirim.com.tr | + | + | English |

Only the members who shared their contact information with VIOP are listed. In order to access to the full Member-list of VİOP, click on the following link, please.

Order Methods

One of the following four methods for price determining must be chosen for the orders to be entered in the trading system.

Limit Order (LMT)

A limit order is the order method which is used to realize orders at prices of up to the determined price level. Price and quantity must be entered when this method is used.

Market Order*

A market order is the order type which is used to match orders, starting from the best price order in the market at the time the order is entered. "Market" order can be entered only by choosing "Fill or Kill" or "Fill and Kill" order validity.

*It is not allowed use of "Market Order" as of March 1, 2021

Market to Limit Order

Market to Limit Orders are the orders, such as market orders, which are entered only by specifying the quantity without price. Market to Limit Orders execute only with the pending best price orders. The unmatched part of the order become a limit order with the price of the last trade and stay in the order book. A market to limit order is cancelled immediately if there is not pending order on other side.

Stop Order

A Stop Order is a price order which will be activated when the market reaches the price determined by the ordering party for the relevant contract (activation price), or trades at a higher price in the market in the case of buying orders, or at a lower price in the case of selling orders. For stop orders, in addition to order entry method, activation price must be indicated.

Intermonth Strategy Orders

Intermonth strategy orders enable submission of two simultaneous automatic reverse orders (by one order entry with spread price) for different contract months of traded futures contracts. Different contract months composing the strategy are called the "legs" of the strategy where "M1" refers to the nearest contract month and "M2" refers to the second nearest (far) contract month. Rules of operation of strategy orders are given below:

- Strategy Buy Order: Order is submitted to the System taking into account the spread price (far month contract bid price- near month contract offer price) composing far month contract (M2) buy and near month contract (M1) sell trade.

- Strategy Sell Order: Order is submitted to the System taking into the account the spread price (far month contract offer price-near month contract bid price) composing far month contract (M2) sell and near month contract (M1) buy trade.

- Strategy order codes which are similar to the contract codes are used at order entry.

- Buy or sell strategy orders can be entered with negative price as long as the price limits are satisfied.

- Maximum order quantity of a strategy order equals that of the contracts composing the strategy.

- Strategy order entry is not accepted for durations other than Limit and Day. Strategy orders can not be linked to any condition and can not be used for trade reporting.

- Matching: The System initially checks whether the price and quantitiy of a buy or sell strategy order can be met with open orders of near/far month contracts or not, and simultaneously matches the strategy order with these orders if the conditions are satisfied. If the spread and or quantity can not be met with open orders of the contracts, this time the System looks for a (counter) strategy order satisfying the conditions. If such an order exists in the System, appropriate prices for far and near month contracts are determined based on the spread, best bid/best offer and base prices of the related contracts and automatic trades at the far and near month contracts are generated.

- Automatic trades are not included in settlement price calculations and price statistics like the last, low and high of the far and near month contracts composing the strategy and do not activate stop orders with inactive status based on the last price condition. Trade parties can inquire automatic prices for both contract months through trading workstations or FixAPI Drop-Copy intraday, and through trade book at the end of the day.

Price Limits: Upper and lower price limits for strategy orders are calculated based on the following formulas:

Lower Limit= (Far Month Contract Base Price- Near Month Contract Base Price)-k

Upper Limit= (Far Month Contract Base Price- Near Month Contract Base Price)+k

- In case trades in any of the legs/contract months composing the strategy are suspended due to any reason, strategy order entry is not allowed.

Validity Period for Orders

One of the following four options regarding the validity period for the order must be chosen while submitting the order.

Fill or Kill (FOK)

It is the order method that requires order to be matched in whole upon the entry or activation otherwise cancelled in whole.

Fill and Kill (FaK)

Upon order entry or activation, the order is matched in full or in part. The unmatched quantity shall be cancelled.

Daily Order (DAY)

The order is valid for the day on which it is entered. Unless it is partly or entirely fulfilled by the end of the day, it will be automatically cancelled by the trading system.

Good Till Cancel Order (GTC)

The order is valid until it is cancelled. Good till cancel orders are valid until the maturity of the contract and will be automatically cancelled by the system at the end of maturity, unless cancelled, or matched.

Good Till Date Orders (GTD)

Date orders are valid by the date entered in the system. Unless partly or entirely matched or cancelled by the specified date, they will be automatically cancelled by the system at the end of the specified day. The system does not accept orders with dates further than the end of the maturity of the contract.

Orders that fall out of the daily price change limits may be entered. Such orders are subject to trade when they are within the limits of price change limits.

| Order Methods | Validity Period for Orders |

|---|---|

| Limit (LMT) | Daily Order (DAY) |

| Market* | Fill or Kill (FOK) |

| Market to Limit Order | Fill and Kill (FaK) |

| Stop Order | Good Till Cancel Order (GTC) |

| Strategy (STJ) | Good Till Date Orders (GTD) |

*It is not allowed use of "Market Order" as of March 1, 2021

Maximum Order Sizes

Price and quantity control is done by the system at order entry. Orders that do not match the features of the corresponding trading day part can not be entered into the system. The minimum and maximum order sizes applicable in the Market are as follows:

Order Sizes for Single Stock Futures and Options

| Underlying Asset Closing Price | Minimum Order Quantity | Maksimum Order Quantity |

|---|---|---|

| 0-2,49 | 1 | 40.000 |

| 2,50-4,99 | 1 | 20.000 |

| 5,00-9,99 | 1 | 10.000 |

| 10,00-19,99 | 1 | 5.000 |

| 20,00-39,99 | 1 | 2.500 |

| 40,00-79,99 | 1 | 1.250 |

| 80,00-149,99 | 1 | 750 |

| 150,00-249,99 | 1 | 350 |

| 250,00-499,99 | 1 | 200 |

| 500,00-749,99 | 1 | 125 |

| 750,00-999,99 | 1 | 75 |

| >1.000,00 | 1 | 50 |

Order Sizes for Index, Currency, Gold, Silver, Palladium, Platinum, Copper, Base Load Electricity, TLREF and Other Contracts

| Board | Index Contracts | Currency Contracts | USD/Ounce Gold Contracts | Gold Contracts | USD/Ounce Silver Contracts | USD/Ounce Palladium Contracts | USD/Ounce Platinum Contracts | USD/Tonne Copper Contracts | Base Load Electricity Contracts | TLREF Contracts | Other Contracts |

| Main Board (Minimum Order Quantity) | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Main Board (Maximum Order Quantity) | 2.000 | 5.000 | 1.250 | 25.000 | 5.000 | 500 | 500 | 500 | 50 | 100 | 2.000 |

Regulations of trade reporting for Single Stock Futures and Options

| Underlying Asset Closing Price | Minimum Order Quantity | Maximum Order Quantity | Condition for Trade Reporting Approval |

|---|---|---|---|

| 0-2,49 | 80.000 | 320.000 | Trade reporting has to be realized between the price interval limits of the related contract. |

| 2,50-4,99 | 40.000 | 160.000 | |

| 5,00-9,99 | 20.000 | 80.000 | |

| 10,00-19,99 | 10.000 | 40.000 | |

| 20,00-39,99 | 5.000 | 20.000 | |

| 40,00-79,99 | 2.500 | 10.000 | |

| 80,00-149,99 | 1.250 | 5.000 | |

| 150,00-249,99 | 700 | 2.800 | |

| 250,00-499,99 | 400 | 1.600 | |

| 500,00-749,99 | 250 | 1.000 | |

| 750,00-999,99 | 175 | 700 | |

| >1.000,00 | 100 | 400 |

Regulations of trade reporting for Index, Currency, Gold, Silver, Palladium, Platinum, Copper, Base Load Electricity, TLREF and Other Contracts

| Contract | Minimum Order Quantity | Maximum Order Quantity | Condition for Trade Reporting Approval |

|---|---|---|---|

| Index Contracts | 2.000 | 4.000 | Trade reporting has to be realized between the price interval limits of the related contract. |

| Currency Contracts | 5.000 | 10.000 | |

| USD/Ounce Gold Contracts | 1.250 | 2.500 | |

| Gold Contracts | 25.000 | 50.000 | |

| USD/Ounce Silver Contracts | 5.000 | 10.000 | |

| USD/Ounce Palladium Contracts | 500 | 1.000 | |

| USD/Ounce Platinum Contracts | 500 | 1.000 | |

| USD/Tonne Copper Contracts | 500 | 1.000 | |

| Base Load Electricity Contracts | 50 | 500 | |

| TLREF Futures Contracts | 100 | 1.000 | |

| Physically Delivered Government Bond Futures | 200 | 2.000 | |

| Other Contracts | 2.000 | 4.000 |

| VIOP Contracts | Ticker Symbol | |

|---|---|---|

| Futures Contracts | Bloomberg | Reuters |

| BIST30 Index Futures Contracts | XU030 Index CT | 0#XU030: |

| BIST30 Index Futures Intermonth Strategy Orders | N/A | 0#XU030-: |

| BIST Liquid Banks Index Futures Contracts | XLBNK Index CT | 0#XLBNK: |

| BIST Liquid 10 Ex Banks Index Futures Contracts | X10XB Index CT | 0#X10XB: |

| BIST Sustainability 25 Index Futures Contracts | XSD25 Index CT | 0#XSD25: |

| USD/TRY Futures Contracts | A1A Curncy | 0#TRYUSD: |

| Pyhsically Delivered USD/TRY Futures Contracts | DTRH2 Curncy | 0#TRYUSDP: |

| Government Bond Futures Contracts | 0#TRT020926T17: 0#TRT131130T14: | |

| USD/TRY Futures Intermonth Strategy Orders | N/A | 0#TRYUSD-: |

| EUR/TRY Futures Contracts | A2A Curncy | 0#TRYEUR: |

| RUB/TRY Futures Contracts | R2A Curncy | 0#TRYRUB: |

| CNH/TRY Futures Contracts | C2A Curncy | 0#TRYCNH: |

| GBP/USD Futures Contracts | C3A Curncy | 0#TRYFGBP: |

| EUR/USD Futures Contracts | B2A Curncy | 0#TRYFEUR: |

| TRY/Gr Gold Futures Contracts | XLA Comdty | 0#XAUTRY: |

| USD/Ounce Gold Futures Contracts | XLTA Comdty | 0#XAUUSD: |

| USD/Ounce Gold Futures Intermonth Strategy Orders | N/A | 0#XAUUSD-: |

| USD/Ounce Silver Futures Contracts | STWA Comdty | 0#XAGUSD: |

| USD/Ounce Palladium Futures Contracts | PCSA Comdty | 0#XPDUSD: |

| USD/Ounce Platinum Futures Contracts | PHWA Comdty | 0#XPTUSD: |

| USD/Tonne Copper Futures Contracts | 0#XCUUSD: | |

| Base Load Futures Contracts | TBEA Comdty | 0#ELCBAS: |

| SASX10 Index Futures Contracts | N/A | 0#SASX10: |

| TLREF Futures Contracts | BISTTREF | .TLREF |

| AEFES Futures Contracts | SFUT TI | AEFESc1 |

| AKBNK Futures Contracts | SFUT TI | AKBNKc1 |

| AKSEN Futures Contracts | SFUT TI | AKSENc1 |

| ALARK Futures Contracts | SFUT TI | ALARKc1 |

| ARCLK Futures Contracts | SFUT TI | ARCLKc1 |

| ASELS Futures Contracts | SFUT TI | ASELSc1 |

| ASTOR Futures Contracts | SFUT TI | ASTORc1 |

| BIMAS Futures Contracts | SFUT TI | BIMASc1 |

| BRSAN Futures Contracts | SFUT TI | BRSANc1 |

| CIMSA Futures Contracts | SFUT TI | CIMSAc1 |

| DOAS Futures Contracts | SFUT TI | DOASc1 |

| DOHOL Futures Contracts | SFUT TI | DOHOLc1 |

| EKGYO Futures Contracts | SFUT TI | EKGYOc1 |

| ENJSA Futures Contracts | SFUT TI | ENJSAc1 |

| ENKAI Future Contacts | SFUT TI | ENKAIc1 |

| EREGL Futures Contracts | SFUT TI | EREGLc1 |

| FROTO Futures Contracts | SFUT TI | FROTOc1 |

| GARAN Futures Contracts | SFUT TI | GARANc1 |

| GUBRF Futures Contracts | SFUT TI | GUBRFc1 |

| HALKB Futures Contracts | SFUT TI | HALKBc1 |

| HEKTS Futures Contracts | SFUT TI | HEKTSc1 |

| ISCTR Futures Contracts | SFUT TI | ISCTRc1 |

| KCHOL Futures Contracts | SFUT TI | KCHOLc1 |

| KONTR Futures Contracts | SFUT TI | KONTRc1 |

| KRDMD Futures Contracts | SFUT TI | KRDMDc1 |

| MGROS Futures Contracts | SFUT TI | MGROSc1 |

| ODAS Futures Contracts | SFUT TI | SKBNKc1 |

| OYAKC Futures Contracts | SFUT TI | OYAKCc1 |

| PETKM Futures Contracts | SFUT TI | PETKMc1 |

| PGSUS Futures Contracts | SFUT TI | PGSUSc1 |

| SAHOL Futures Contracts | SFUT TI | SAHOLc1 |

| SASA Futures Contracts | SFUT TI | SASAc1 |

| SISE Futures Contracts | SFUT TI | SISEc1 |

| SOKM Futures Contracts | SFUT TI | SOKMc1 |

| TAVHL Futures Contracts | SFUT TI | TAVHLc1 |

| TCELL Futures Contracts | SFUT TI | TCELLc1 |

| THYAO Futures Contracts | SFUT TI | THYAOc1 |

| TKFEN Futures Contracts | SFUT TI | TKFENc1 |

| TOASO Futures Contracts | SFUT TI | TOASOc1 |

| TRALT Futures Contracts | SFUT TI | TRALTc1 |

| TRMET Futures Contracts | SFUT TI | TRMETc1 |

| TSKB Futures Contracts | SFUT TI | TSKBc1 |

| TTKOM Futures Contracts | SFUT TI | TTKOMc1 |

| TUPRS Futures Contracts | SFUT TI | TUPRSc1 |

| VAKBN Futures Contracts | SFUT TI | VAKBNc1 |

| VESTL Futures Contracts | SFUT TI | VESTLc1 |

| ULKER Futures Contracts | SFUT TI | ULKERc1 |

| YKBNK Futures Contracts | SFUT TI | YKBNKc1 |

| Option Contracts | Bloomberg | Reuters |

|---|---|---|

| BIST30 Index Option Contracts | XU030X Index OMON | 0#XU030*.IS |

| USD/TRY Option Contracts | TYX Curncy OMON | 0#TRYF*.IS |

| Physically Delivered Option Contracts | TYP Curncy OMON | 0#TRYFp*.IS |

| AKBNK Option Contracts | AKBNK TI Equity OMON | 0#AKBNKE*.IS |

| ALARK Option Contracts | ALARK TI Equity OMON | 0#ALARKE*.IS |

| ASELS Option Contracts | ASELS TI Equity OMON | 0#ASELSE*.IS |

| BIMAS Option Contracts | BIMAS TI Equity OMON | 0#BIMASE*.IS |

| EREGL Option Contracts | EREGL TI Equity OMON | 0#EREGLE*.IS |

| ENKAI Option Contracts | ENKAI TI Equity OMON | 0#ENKAIE*.IS |

| FROTO Option Contracts | FROTOTI Equity OMON | 0#FROTOE*.IS |

| GARAN Option Contracts | GARAN TI Equity OMON | 0#GARANE*.IS |

| ISCTR Option Contracts | ISCTR TI Equity OMON | 0#ISCTRE*.IS |

| SAHOL Option Contracts | SAHOL TI Equity OMON | 0#SAHOLE*.IS |

| TAVHL Option Contracts | TAVHL TI Equity OMON | 0#TAVHLE*.IS |

| TCELL Option Contracts | TCELL TI Equity OMON | 0#TCELLE*.IS |

| THYAO Option Contracts | THYAO TI Equity OMON | 0#THYAOE*.IS |

| TUPRS Option Contracts | TUPRS TI Equity OMON | 0#TUPRSE*.IS |

| VAKBN Option Contracts | VAKBN TI Equity OMON | 0#VAKBNE*.IS |

| YKBNK Option Contracts | YKBNK TI Equity OMON | 0#YKBNKE*.IS |

| ARCLK Option Contracts | ARCLK TI Equity OMON | 0#ARCLK*.IS |

| EKGYO Option Contracts | EKGYO TI Equity OMON | 0#EKGYO*.IS |

| HALKB Option Contracts | HALKB TI Equity OMON | 0#HALKB*.IS |

| KCHOL Option Contracts | KCHOL TI Equity OMON | 0#KCHOL*.IS |

| KRDMD Option Contracts | KRDMD TI Equity OMON | 0#KRDMD*.IS |

| PETKM Option Contracts | PETKM TI Equity OMON | 0#PETKM*.IS |

| PGSUS Option Contracts | PGSUS TI Equity OMON | 0#PGSUS*.IS |

| SISE Option Contracts | SISE TI Equity OMON | 0#SISE*.IS |

| TOASO Option Contracts | TOASO TI Equity OMON | 0#TOASO*.IS |

| TTKOM Option Contracts | TTKOM TI Equity OMON | 0#TTKOM*.IS |

For further information please refer to the Derivatives Market Procedure

Correction of Erroneous Trades (Mistyped Account Numbers)

The correction of trading errors associated with mistyped account numbers is the process of forming new transactions at trading system to allow the positions/open orders to be transferred to correct account by the member itself using the clearing workstation.

The workflow concerning the correction of erroneous trades executed faulty as a result of the mistyped account numbers for the orders placed on the trading system shall be conducted on clearing workplace by member/s' user.

Trade Cancellation

Without prejudice to the provisions of Article 33 of the Regulation, trades that occur due to erroneous order(s) may be canceled by the Exchange under the following rules.

a) Erroneous trade/trades shall be executed as a result of one of members' erroneous order at least.

b) All requirements stated below shall be fulfilled in time of cancellation request since erroneous trade/trades may be subject to cancellation.

i. Application Period For Erroneous Trade Cancellation: Application for erroneous trade cancellation can be made within 30 minutes from the time the trade is executed. Deadline of application for trade cancellation is 18:30 for normal session trades.

ii. Required Information In Application For Erroneous Trade Cancellation: Order number subject to cancellation, contract and account number relating to erroneous trade/trades due to the erroneous order shall be submitted during the application period. Trade number, price and trade quantity of erroneous trades executed as a result of the related order are also required following the application.

iii. No Bust Range: Trades executed at the prices that are out of no bust range which are calculated by using reference price can be subject to cancellation. No bust ranges are stated below table on the related contract basis.

Contract Class | Price Change Calculated from Reference Price |

|---|---|

BIST30 Index and Single Stock Futures | +/- 5% |

Currency Futures | +/- 3% |

Other Futures Contracts | +/- 4% |

All Call and Put Options | Maximum of +/-50% of the reference premium price or market maker maximum spread defined for the related contract |

iv. Minimum Loss Amount Generated As A Result of Trade/Trades Which Is/Are Subject To Cancellation: Minimum loss amount calculated by comparing reference price and prices of trade/trades subject to erroneous trade cancellation shall be TRY 200,000 for applications before 17:30 and TRY 800,000 for applications made at 17:30 and after during the normal session and TRY 200,000 for the applications made during the evening session.

v. Reference Price: Reference price, which is calculated with one or more of the following methods in order to determine the price that will reflect the market fairly, is used to clarify acceptable price levels for trade cancellation and losses due to related erroneous trade.;

i. Price/prices before the erroneous trade,

ii. Price/prices after the erroneous trade,

iii. Settlement price of the previous day,

iv. The first trade price in case erroneous trade/trades are executed with a pending order,

v. Theoretical price calculated according to the spot price of the related underlying asset or the prices of other contract months,

vi. Prices taken from market makers,

vii. If it is decided that above mentioned methods does not reflect the market failry, a different reference price may be determined by General Management

c) In cancellation of trades arising from intermonth strategy orders, prices of trades executed in the related contracts and strategy order price are considered together.

ç) Erroneous trade cancellation requests which fulfill all the requirements stated above can be submitted by either one or both sides of the trade via Trading Workstations (TW, Omnet API) or e-mail to viop@borsaistanbul.com. Cancellation requests for erroneous trade at Evening Session can be submitted by only via e-mail to viop@borsaistanbul.com. Members can also reach VIOP via telephone numbered 0212 298 2427/3, however to be a valid cancellation request an has to be sent to viop@borsaistanbul.com.

d) To be subject to cancellation, whether price tendency of the market is in line with the erroneous trade price or not may be taken into consideration separately.

e) In case trade cancellation is decided, cancellation decisions are announced pursuant to the relevant legislation. Before the cancellation, trading on the relevant contract may be suspended. Also, parties of the relevant trade may be informed about the cancellation.

f) Even if the above conditions are met with regard to the cancellation of the erroneous trade, Article 33 of the Regulation shall be applied if the above conditions are not met, while the right of the Exchange to cancel or not to fulfill the whole or part of the cancellation request is reserved.

g) Erroneous trade reports, even if the above mentioned conditions are not met, may be cancelled if the parties have approvals.

h) Application for a trade cancellation for erroneous trades in the Evening Session is evaluated in the following Normal Session. If the application is considered as acceptable, the related erroneous trade/trades are cancelled

ı) In the evaluation of trade cancellation request, requests may be evaluated together or seperately taking the relationship between orders and trades into account for the same investor.

For further information regarding Correction of Erroneous Trade and Trade Cancellation on VİOP please refer to the Derivatives market Procedure

Market Making Program covers some of the contracts traded at VIOP.

Detailed information about the program can be found in the Sixth Section of the Derivatives Market Procedure .

Rights and obligations of market makers are listed in Appendix-10*, Appendix-11*, Appendix-12 and Appendix-13* of the Derivatives Market Procedure .

*The distribution of the underlying assets in single stock futures contracts by Groups is as follow:

| Group | Underlying Asset |

|---|---|

| Group 1 | AKBNK, ASELS, BIMAS, EKGYO, EREGL, GARAN, ISCTR, KCHOL, PGSUS, SAHOL, SASA, TCELL, THYAO, TUPRS, YKBNK |

| Group 2 | AEFES, ASTOR, ENKAI, FROTO, GUBRF, HALKB, KRDMD, MGROS, PETKM, SISE, TAVHL, TOASO, TRALT, TTKOM, VAKBN |

| Group 3 | AKSEN, ALARK, ARCLK, BRSAN, CIMSA, DOAS, DOHOL, ENJSA, HEKTS, KONTR, ODAS, OYAKC, SOKM, TKFEN, TRMET, TSKB, ULKER, VESTL |

| BOARD | MEMBER | CONTRACT |

|---|---|---|

| Index Options | İŞ YATIRIM | BIST30 Index |

| AK YATIRIM | BIST30 Index | |

| GARANTİ YATIRIM | BIST30 Index | |

| QNB YATIRIM | BIST30 Index | |

| TACİRLER YATIRIM | BIST30 Index | |

| Index Futures | QNB YATIRIM | BIST Liquid Banks Index BIST Liquid 10 Ex Banks Index |

| TACİRLER YATIRIM | BIST Liquid Banks Index BIST Liquid 10 Ex Banks Index | |

| OSMANLI YATIRIM | BIST Liquid Banks Index | |

| FX Options | QNB YATIRIM | USD/TRY |

| AKBANK | USD/TRY | |

| TÜRKİYE GARANTİ BANKASI | USD/TRY | |

| QNB BANK | USD/TRY | |

| Electricity Futures | AK YATIRIM | Monthly Base-Load Electricity Quarterly Base-Load Electricity |

| Equity Options | QNB YATIRIM | AKBNK, ALARK, ASELS, ARCLK, BIMAS, EKGYO, ENKAI, EREGL, FROTO, GARAN, HALKB, ISCTR, KCHOL, KRDMD, PETKM, PGSUS SAHOL, SISE, TCELL, TOASO, TTKOM, THYAO, TAVHL, TUPRS, ULKER, VAKBN, YKBNK |

| TACİRLER YATIRIM | AKBNK, ASELS, EKGYO, EREGL, GARAN, HALKB, ISCTR, SISE,THYAO, YKBNK | |

| GARANTİ YATIRIM | AKBNK, ALARK, ARCLK, ASELS, BIMAS, EKGYO, ENKAI, EREGL, FROTO, HALKB, ISCTR, KCHOL, KRDMD, PETKM, PGSUS, SAHOL, SISE, TAVHL, TCELL, THYAO, TOASO, TTKOM, TUPRS, VAKBN, YKBNK | |

| Single Stock Futures | İŞ YATIRIM | AEFES, AKBNK, ASELS, ASTOR, BIMAS, EKGYO, ENKAI, EREGL, FROTO, GARAN, GUBRF, ISCTR, KCHOL, KRDMD, MGROS, PETKM, PGSUS, SAHOL, SASA, SISE, TAVHL, TCELL, THYAO, TOASO, TTKOM, TRALT, TUPRS, ULKER, YKBNK |

| QNB YATIRIM | AEFES, AKBNK, AKSEN, ALARK, ARCLK, ASELS,ASTOR, BIMAS, BRSAN, CIMSA, DOAS, DOHOL, EKGYO, ENJSA, ENKAI, EREGL, FROTO, GARAN, GUBRF, HALKB, HEKTS, ISCTR, KCHOL, KONTR, KRDMD, MGROS, ODAS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, SOKM, TAVHL, TCELL, THYAO, TKFEN, TOASO, TRALT, TRMET, TSKB, TTKOM, TUPRS, VAKBN, VESTL, YKBNK | |

| OSMANLI YATIRIM | AEFES, AKBNK, AKSEN, ALARK, ARCLK, ASELS, ASTOR, BIMAS, BRSAN, CIMSA, DOAS, DOHOL, EKGYO, ENJSA, ENKAI, EREGL, FROTO, GARAN, GUBRF, HALKB, HEKTS, ISCTR, KCHOL, KONTR, KRDMD, MGROS, ODAS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, SOKM, TAVHL, THYAO, TKFEN, TOASO, TRALT, TRMET, TCELL, TSKB, TTKOM, ULKER, VAKBNK, VESTL, YKBNK | |

| AK YATIRIM | AKBNK, ARCLK, BIMAS, EKGYO, EREGL, GARAN, HALKB, ISCTR, KCHOL, PETKM, SAHOL, SASA, SISE, TCELL, TRALT, TUPRS, VAKBN, VESTL, YKBNK | |

| TACİRLER YATIRIM | AEFES, AKBNK, AKSEN, ALARK, ARCLK, ASELS, BIMAS, DOHOL, EKGYO, ENJSA, EREGL, FROTO, GARAN, GUBRF, HALKB, HEKTS, ISCTR, KCHOL, KRDMD, MGROS, ODAS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, SOKM, TAVHL, TCELL, THYAO, TKFEN, TOASO, TRALT, TRMET, TSKB, TTKOM, TUPRS, VAKBN,VESTL, YKBNK | |

| YAPI KREDİ YATIRIM | ASELS, EKGYO, EREGL, KCHOL, KRDMD, PETKM, SAHOL, SISE, TCELL, THYAO, TTKOM | |

| GEDİK YATIRIM | AEFES, AKBNK, AKSEN, ALARK, ARCLK, ASELS, ASTOR, BIMAS, BRSAN, CIMSA, DOAS, DOHOL, EKGYO, ENJSA, ENKAI, EREGL, FROTO, GARAN, GUBRF, HALKB, HEKTS, ISCTR, KCHOL, KONTR, KRDMD, MGROS, ODAS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, SOKM, TAVHL, TCELL, THYAO, TKFEN, TOASO, TRALT, TRMET, TSKB, TTKOM, TUPRS, ULKER, VAKBN, VESTL, YKBNK | |

| GARANTİ YATIRIM | AEFES, AKBNK, AKSEN, ALARK, ARCLK, ASELS, ASTOR, BIMAS, BRSAN, CIMSA, DOAS, DOHOL, EKGYO, ENJSA, ENKAI, EREGL, FROTO, GUBRF, HALKB, HEKTS, ISCTR, KCHOL, KONTR, KRDMD, MGROS, ODAS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, SOKM, TAVHL, TCELL, THYAO, TKFEN, TOASO, TRALT, TRMET, TSKB, TTKOM, TUPRS, ULKER, VAKBN, VESTL, YKBNK | |

| VAKIF YATIRIM | AKBNK, ARCLK, ASELS,BIMAS, DOHOL, EKGYO, EREGL, FROTO, GARAN, GUBRF, HALKB, ISCTR, KCHOL, KRDMD, MGROS, PETKM, PGSUS, SAHOL, SASA, SISE, TAVHL, TCELL, THYAO, TKFEN, TRALT, TSKB, TTKOM, TUPRS, VAKBN, YKBNK | |

| TERA YATIRIM | AKBNK, ALARK, ASELS, ASTOR, BIMAS, DOHOL, EKGYO, EREGL, FROTO, GARAN, GUBRF, HALKB, ISCTR, KCHOL, KRDMD, MGROS, PETKM, PGSUS, SAHOL, SASA, SISE, TCELL, THYAO, TOASO, TRALT, TRMET, TTKOM, TUPRS, VAKBN, YKBNK | |

| YATIRIM FİNANSMAN | AEFES, AKBNK, ALARK, ARCLK, ASELS, ASTOR, BIMAS, BRSAN, CIMSA, EKGYO, ENKAI, EREGL, FROTO, GARAN, HALKB, HEKTS, ISCTR, KCHOL, KONTR, KRDMD, MGROS, OYAKC, PETKM, PGSUS, SAHOL, SASA, SISE, TCELL, THYAO, TKFEN, TOASO, TRALT, TTKOM, TUPRS, ULKER, YKBNK | |

| Precious Metals Futures | İŞ YATIRIM | TRY/GR GOLD, USD/OUNCE GOLD, USD/OUNCE SILVER |

| GEDİK YATIRIM | USD/OUNCE GOLD, USD/OUNCE SILVER | |

| VAKIF YATIRIM | USD/OUNCE GOLD, USD/OUNCE SILVER | |

| QNB YATIRIM | TRY/GR GOLD, USD/OUNCE SILVER, USD/OUNCE GOLD | |

| TÜRKİYE GARANTİ BANKASI | TRY/GR GOLD, USD/OUNCE GOLD | |

| OSMANLI YATIRIM | TRY/GR GOLD, USD/OUNCE GOLD, USD/OUNCE SILVER | |

| INFO YATIRIM | TRY/GR GOLD, USD/OUNCE GOLD | |

| YATIRIM FİNANSMAN | TRY/GR GOLD, USD/OUNCE GOLD | |

| FX Futures | ICBC TURKEY YATIRIM | CNH/TRY |

An exchange fee is charged for buy and sell transactions of futures and options contracts at Borsa İstanbul:

- For index futures and index option contracts an exchange fee of 0.004% (four hundred-thousandths) is charged. For future and option contracts the exchange fee is calculated based on the traded value (the product of price, contract size and number of contracts).

- For TLREF and government bond futures contracts an exchange fee of 0.001% (one hundred-thousandths) is charged. The exchange fee is calculated based on the nominal value (the product of nominal value and number of contracts)

- For the other futures and option contracts the exchange fee is charged as 0.003% (three hundred-thousandths) of the traded value of futures and options.

The taxation of the income on VIOP contracts are given in the table below.

| Withholding TAX (WHT) | Banking and Insurance Transactions TAX (BITT) | ||||

|---|---|---|---|---|---|

| TAXATION OF INCOME ON VIOP CONTRACTS | Individual Investors | Corporate Investors* | BITT taxpayers | ||

| Resident | Non-Resident | Resident Capital Companies (limited liability companies and joint stock companies) and Investment Funds | Non-Resident Capital Companies (limited liability companies and joint stock companies) and Investment Funds | ||

| The income generated from the positions in the contracts written on Equity and Equity Index | 0% | 0% | 0% | 0% | Within the scope of exemption. |

| The income generated from the positions in all other contracts | 10% | 10% | 0% | 0% | Within the scope of exemption. |

* All other Resident and Non-Resident Companies are subject to %10 WHT.