Trading on the Equity Market is carried out in the following sub-markets:

The grouping, depends on the market cap and market value criteria during the public offering of the companies to be listed on the Exchange.

Criteria for Determining the Market Segments

a) MC: Total market cap. calculated over the company's total paid in capital.

b) MCFF: Market cap. of the shares of the company in actual free float calculated according to the criteria determined by the Board as the free floating shares at the end of the period x average of the one-year adjusted closing prices.

c) FFR: The ratio of the shares of the company in the actual free float calculated according to the criteria determined by the Board to the company’s paid in capital

d) Preference Criterion: To be decided by the General Directorate of Borsa Istanbul, whether the variations created regarding any equity group will be considered as “preference” or not in the evaluations relating to; shareholders forming a certain group of board members, and rights to be selected among certain share groups and minorities, the right to propose a candidate for the membership of the board, the right to be represented in the Board, dividend, liquidation share, pre-emptive rights and voting right or for the rights such as a new shareholding, which is not foreseen here, granting a different or superior right to a share

e) Domestic Funds: Average net asset value of the share of the equity in the portfolios of the Mutual Funds and Pension Mutual Funds which are under the supervision of CMB according to CRA data,

f) Liquidity: The ratio of the traded value of 1 million TL to the average price change rate of the equity on a daily basis

g) Additional criterion- Dividend Return: Total net cash dividend for the last 3 years / market cap. at the end of the period

h) If FFR is below 5 %, additional criteria are not applicable

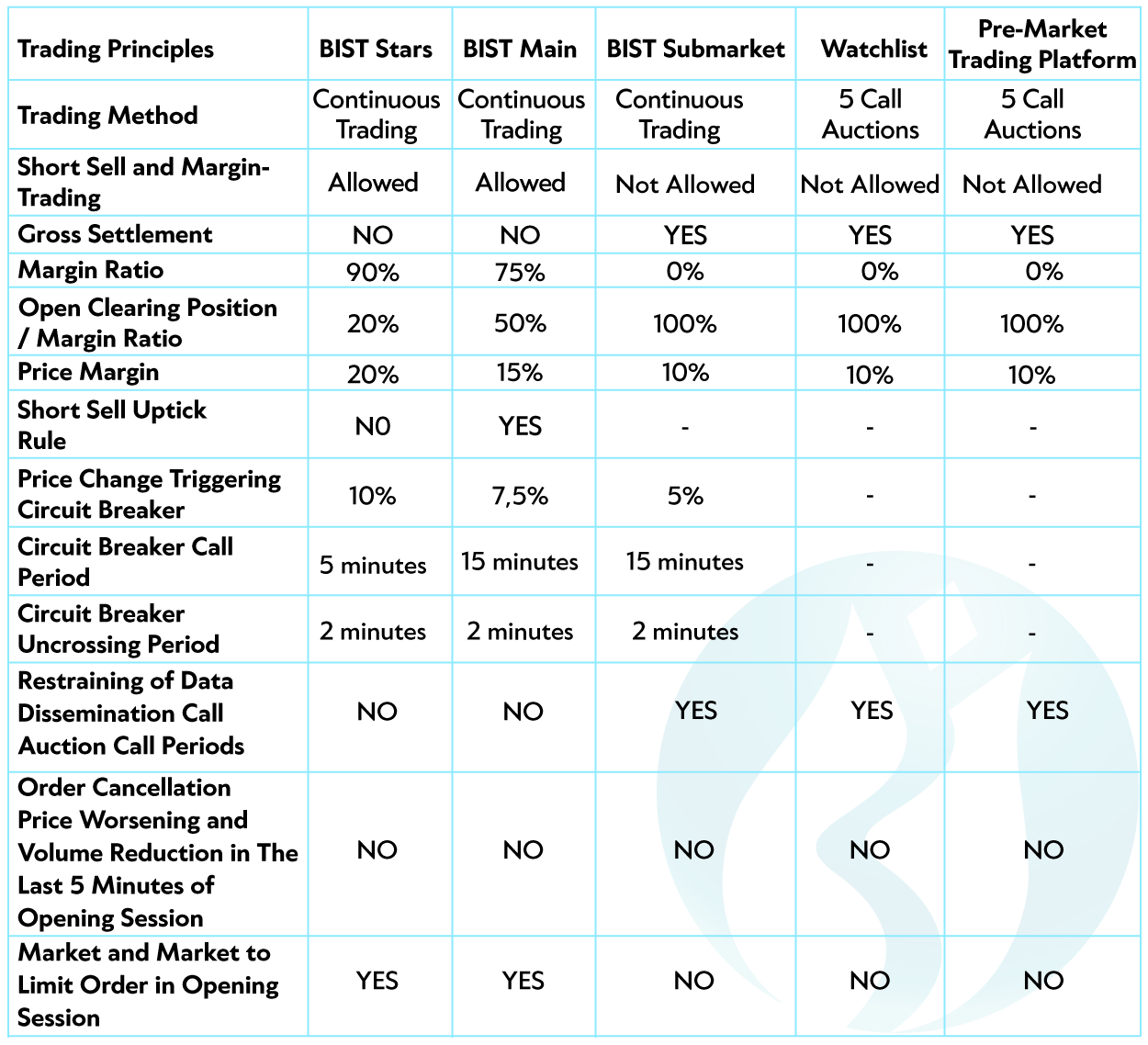

Trading Principles in Market Segments

a) Margin Ratio: Indicates to what extend the related equity can be considered as margin in the margin calculation for margin trading, short sale, borrowing or lending transactions.

In the regulations of the Board regarding the margin-trading and short sale, the provisions of ability to accept buy orders without requiring any collateral within the exceptions determined by taking into account the assets and solvency of the customers, are only applicable to the equities in the BIST Stars. The provisions decided by the Board on the basis of investor, market segment and equity are reserved.

For the transactions related to the collective investment institutions and pension funds that are subject to the Capital Market Law; in accordance with the regulations of the Board regarding margin-trading and short sale, within the scope of exceptions determined by taking into account the assets and solvency of the customer, provisions of ability to accept buy orders without requiring any collateral may also be applicable for the equities in the BIST Main Market.

b) Open Clearing Position /Margin Ratio: Indicates the minimum amount of margin for the relevant equity when the open clearing position that may occur at a certain moment or until the settlement takes place.

Above trading principles are general principles, however it must be noted that the below applications implied by regarding announcements and CMB decisions are still in effect until further notice:

- Short selling which had been permitted only on shares listed within the BIST 50 Index pursuant to the Capital Markets Board’s decision dated 05/12/2024, was banned on Borsa İstanbul Equity Market from 24/03/2025 until the end of the session on 25/04/2025 with the CMB's decision dated 23/03/2025.This prohibition has been extended until the end of the trading session on 04/07/2025 by the CMB’s latest decision dated 30/05/2025.

- Price margin is 10% for equities in BIST Stars, BIST Main, exchange traded funds, real estate certificates, real estate investment funds and venture capital investment funds.

- Circuit breaker for all equities is triggered at 5% and in downward trend only.

- Order collection period for circuit breaker is 15 minutes for all equities.

FORMER EQUITY GROUP REGULATION (REPEALED)

As per the resolution of the Capital Markets Board (CMB) dated 19/09/2019 and numbered 52, the A,B,C,D grouping regulation has been abolished as of 04/11/2019. Instead of the trading principles that are related to this regulation, the trading principles of the new market structure will be valid.

Related Downloads

Lists before 04/11/2019, the date of implementation of the new market structure of the equities in A,B,C and D groups formed as required by the Capital Markets Board’s regulations:

(2015 January – June) - (2015 July – December) - (2016 January - June) - (2016 July – December) - 2017 (January - June) - 2017 (July-December) - 2018 (January-June) - 2018 (July- December) - 2019 (January- June) - 2019 (July- December)

Implementation principles for A, B, C, and D groups determined by Borsa İstanbul General Management.

Lists for 2013-2014:

(2014 October - November - December)

(2014 July - August - September)

(2014 January - February - March)

(2013 October - November - December)

(2013 July - August - September)

(2013 January - February - March)